Loan Ontario: Essential Tips for a Seamless Loaning Experience

Loan Ontario: Essential Tips for a Seamless Loaning Experience

Blog Article

Navigate Your Financial Trip With Reputable Lending Solutions Designed for Your Success

Trustworthy lending services tailored to meet your certain demands can play an essential role in this process, offering an organized method to safeguarding the needed funds for your ambitions. By comprehending the details of various finance options, making educated choices throughout the application procedure, and efficiently taking care of payments, individuals can take advantage of finances as tactical devices for reaching their economic turning points.

Comprehending Your Financial Requirements

Comprehending your economic needs is essential for making informed decisions and attaining economic security. By taking the time to evaluate your monetary situation, you can recognize your long-lasting and temporary objectives, create a budget plan, and create a strategy to reach monetary success.

Additionally, comprehending your economic demands includes recognizing the difference in between important expenses and discretionary costs. Prioritizing your requirements over desires can help you handle your financial resources more properly and stay clear of unnecessary debt. Furthermore, take into consideration factors such as reserve, retired life planning, insurance policy protection, and future economic objectives when assessing your monetary needs.

Discovering Lending Alternatives

When considering your monetary demands, it is necessary to check out numerous loan alternatives available to determine the most ideal remedy for your certain scenarios. Recognizing the different types of financings can aid you make educated choices that line up with your financial goals.

One usual type is a personal lending, which is unsafe and can be made use of for different objectives such as financial debt consolidation, home renovations, or unexpected expenses. Individual finances normally have actually taken care of rates of interest and regular monthly repayments, making it easier to spending plan.

An additional choice is a safe financing, where you provide security such as a car or property. Guaranteed lendings frequently feature lower rates of interest as a result of the minimized risk for the lender.

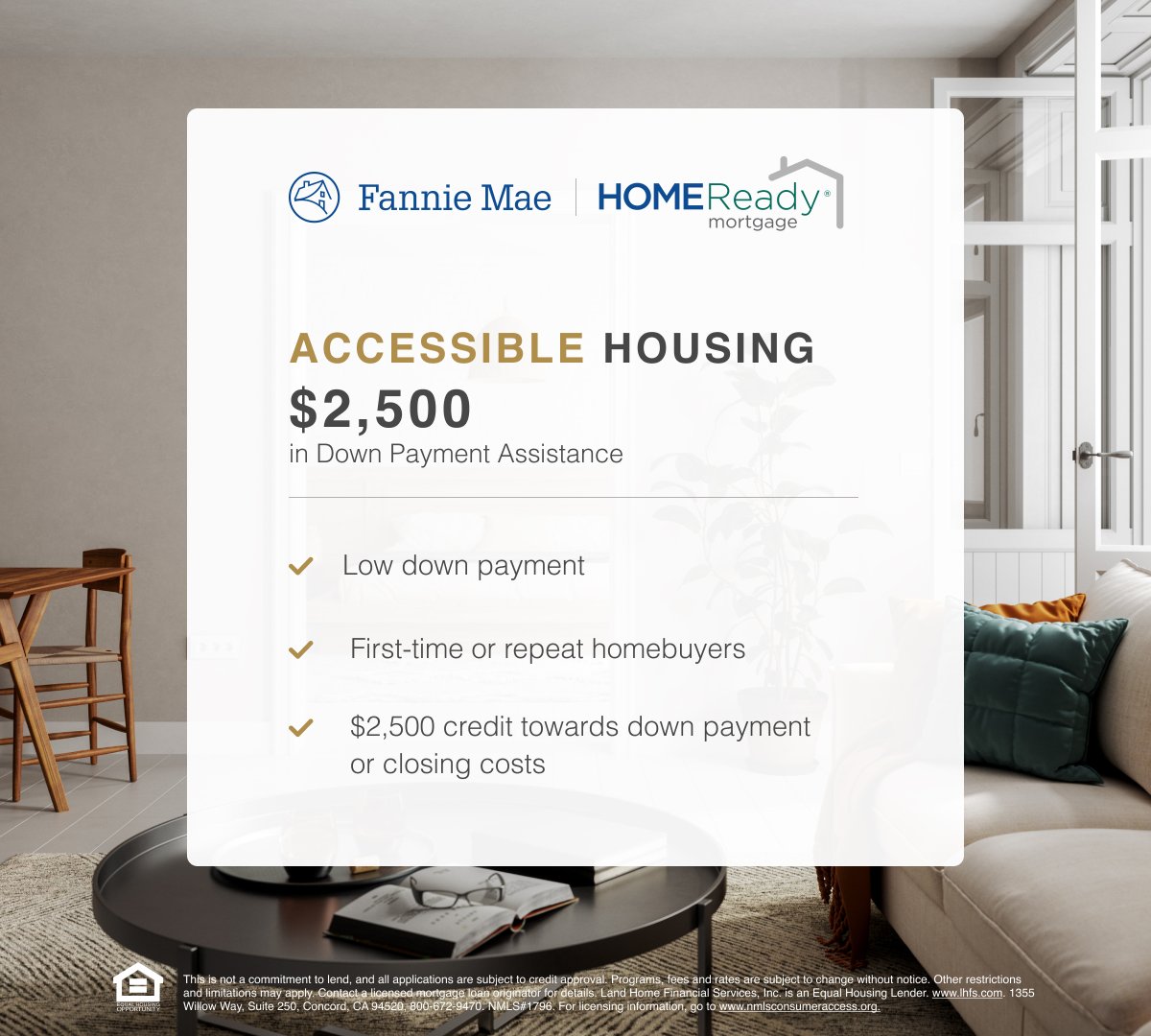

For those aiming to buy a home, a home loan is a prominent selection. Home loans can vary in terms, rates of interest, and deposit requirements, so it's essential to check out different loan providers to find the finest fit for your scenario.

Using for the Right Financing

Browsing the procedure of using for a car loan requires a comprehensive analysis of your economic needs and diligent study into the readily available options. Begin by examining the function of the loan-- whether it is for a significant purchase, financial debt consolidation, emergencies, or other demands.

When you've recognized your monetary needs, it's time to check out the loan products used by numerous lending institutions. Contrast rate of interest, settlement terms, costs, and qualification standards to find the loan that best suits your needs. Furthermore, consider aspects such as the lending institution's online reputation, customer care high quality, and online tools for managing your lending.

When using for a loan, make certain that you give precise and complete info to quicken the authorization procedure. Be prepared to send documents such as proof of revenue, identification, and financial declarations as required. By very carefully picking the best car loan and completing the application carefully, you can set yourself up for economic success.

Taking Care Of Finance Payments

Efficient management of finance repayments is vital for keeping financial stability and meeting your responsibilities properly. To effectively handle lending payments, begin by creating a comprehensive spending plan that outlines your income and expenses. By clearly determining just how much you can designate towards loan settlements monthly, you can ensure prompt payments and stay clear of any type of economic stress. Setting up automatic settlements or reminders can additionally aid you remain on track Click Here and avoid missed or late settlements.

If you come across troubles in making settlements, connect without delay with your loan provider. Many monetary institutions supply alternatives such as financing restructuring, forbearance, or deferment to assist consumers dealing with monetary challenges. Disregarding repayment problems can cause extra costs, an adverse impact on your credit rating rating, and prospective legal effects. Looking for aid and exploring readily available options can help you navigate through short-lived monetary setbacks and prevent long-term effects. By proactively managing your lending settlements, you can preserve monetary wellness and job towards accomplishing your long-term financial objectives.

Leveraging Financings for Economic Success

Leveraging car loans strategically can be an effective tool in achieving financial success and reaching your long-lasting goals. When made use of sensibly, car loans can supply the essential resources to spend in chances that may yield high returns, such as beginning a company, going after higher education and learning, or buying actual estate. easy loans ontario. By leveraging finances, people can accelerate their wealth-building process, as long as they have a clear prepare for repayment and a comprehensive understanding of the threats involved

One secret element of leveraging car loans for financial success is to meticulously assess the terms of the car loan. Recognizing the rate of interest, payment routine, and any affiliated about his costs is crucial to make certain that the car loan straightens with your monetary purposes. In addition, it's important to borrow only what you require and can sensibly pay for to repay to avoid coming under a debt trap.

Conclusion

By comprehending the details of various finance choices, making informed decisions during the application procedure, and properly managing settlements, individuals can leverage finances as calculated devices for reaching their economic turning points. loan ontario. By proactively handling your finance settlements, you can preserve economic wellness and work towards achieving your lasting monetary goals

One trick aspect Look At This of leveraging loans for financial success is to meticulously assess the terms and conditions of the financing.In verdict, recognizing your financial needs, checking out car loan choices, using for the appropriate financing, handling car loan settlements, and leveraging car loans for monetary success are important actions in navigating your financial journey. It is crucial to meticulously consider all facets of fundings and economic choices to guarantee long-lasting monetary security and success.

Report this page